2025 has seen some of the lowest U.S. mortgage rates in recent years, driven by modest declines in Treasury yields and speculation about Fed rate cuts. Despite broader economic pressures, homebuyers and refinancers can find favorable rates—but timing and strategy matter. This guide breaks down the current rate landscape and forecasts through the year.

Current Snapshot: Today’s Mortgage Rates

- The national average for a 30-year fixed mortgage has dipped to 6.56%, marking a 10-month low.AP News

- As of Thursday, September 4, 2025:

- 30-year fixed: ~6.57%

- 15-year fixed: ~5.76%

- 10-year fixed: ~5.73%

- 5/1 ARM (Adjustable-Rate Mortgage): ~5.78%Bankrate

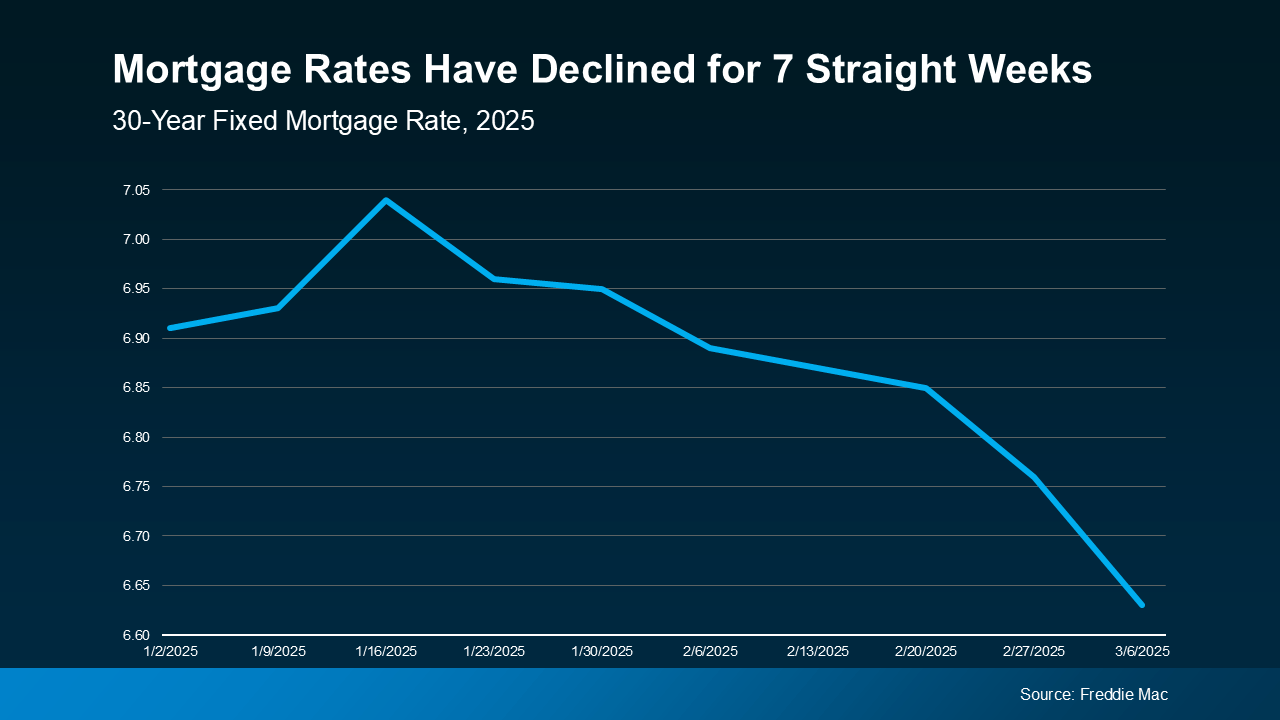

- Freddie Mac’s weekly data aligns, showing a 30-year fixed rate of 6.56% as of August 28, 2025, down from 6.58% the prior week.FREDThe Mortgage Reports

Why Rates Are Starting to Fall

- 10-Year Treasury Yield Dips

Mortgage rates more closely follow the 10-year Treasury yield than Federal Reserve policy. A recent retreat in long-term yields has helped push mortgage rates lower—even without Fed rate cuts.Barron’s - Optimism Around Fed Cuts

While not yet implemented, the expectation of upcoming rate reductions may keep borrowing costs subdued—though the full effect may take time to materialize.Barron’sKiplinger - Forecasted Average Near 6%

Major housing organizations like the National Association of Realtors (NAR) project that 30-year fixed rates will average around 6.0% in 2025—a more stable environment promising to boost housing activity.Reuters

However, some analysts caution rates may hold between 6.0% and 6.8%, influenced by inflation and fiscal pressures.AP NewsInvestopedia

Fixed vs. Adjustable-Rate Loans

- Fixed-rate mortgages: Now averaging ~6.5–6.6%, offer predictability and consistency for long-term borrowers.

- Adjustable-rate mortgages (ARMs): Expected to fall toward 5.5%, making them more attractive in the short term—though they carry future rate uncertainty.Barron’s

Strategy Tips for Homebuyers & Refinancers

- Lock in a Rate Now

Given that current rates are at annual lows, a locked fixed-rate mortgage may be wise, particularly if rates remain elevated. - Consider an ARM if You’re Short-Term

If you plan to move or refinance within 5–10 years, ARMs can offer lower initial payments.Barron’s - Check for Local Offers

Platforms like Bankrate suggest many lenders are offering rates below the national average—shop around for the best deal.Bankrate - Be Prepared

High demand and limited inventory continue to challenge affordability. Preparing your down payment and credit documentation can help speed approval.Kiplinger

Summary Table

| Mortgage Type | Average Rate (2025) | Notes |

|---|---|---|

| 30-Year Fixed | ~6.56% | Lowest point seen since late 2024 |

| 15-Year Fixed | ~5.76% | Better for faster payoff and lower lifetime cost |

| 10-Year Fixed | ~5.73% | Rare option, good short-term choice |

| 5/1 ARM | ~5.78%, possibly lower | Best for buyers planning to refinance or move soon |

| Projected (NAR) | ~6.0% | Expectation for yearly average in 2025 |

Conclusion

As of September 2025, U.S. mortgage rates are hovering near multi-month lows around 6.5%. While the pullback is encouraging, rates are still higher than the pandemic-era lows. If you’re locking in a mortgage or refinancing, it’s a favorable window—especially if you’re considering ARMs or 15-year terms. Remain attentive to economic signals and lender offerings to optimize your borrowing costs.